Strategic Collaborations for Strength: Bagley Risk Management

Exactly How Animals Risk Security (LRP) Insurance Can Protect Your Livestock Financial Investment

Animals Threat Defense (LRP) insurance stands as a reputable guard versus the unforeseeable nature of the market, using a critical strategy to safeguarding your assets. By delving into the intricacies of LRP insurance coverage and its diverse benefits, livestock producers can fortify their investments with a layer of safety that transcends market changes.

Understanding Livestock Threat Security (LRP) Insurance Coverage

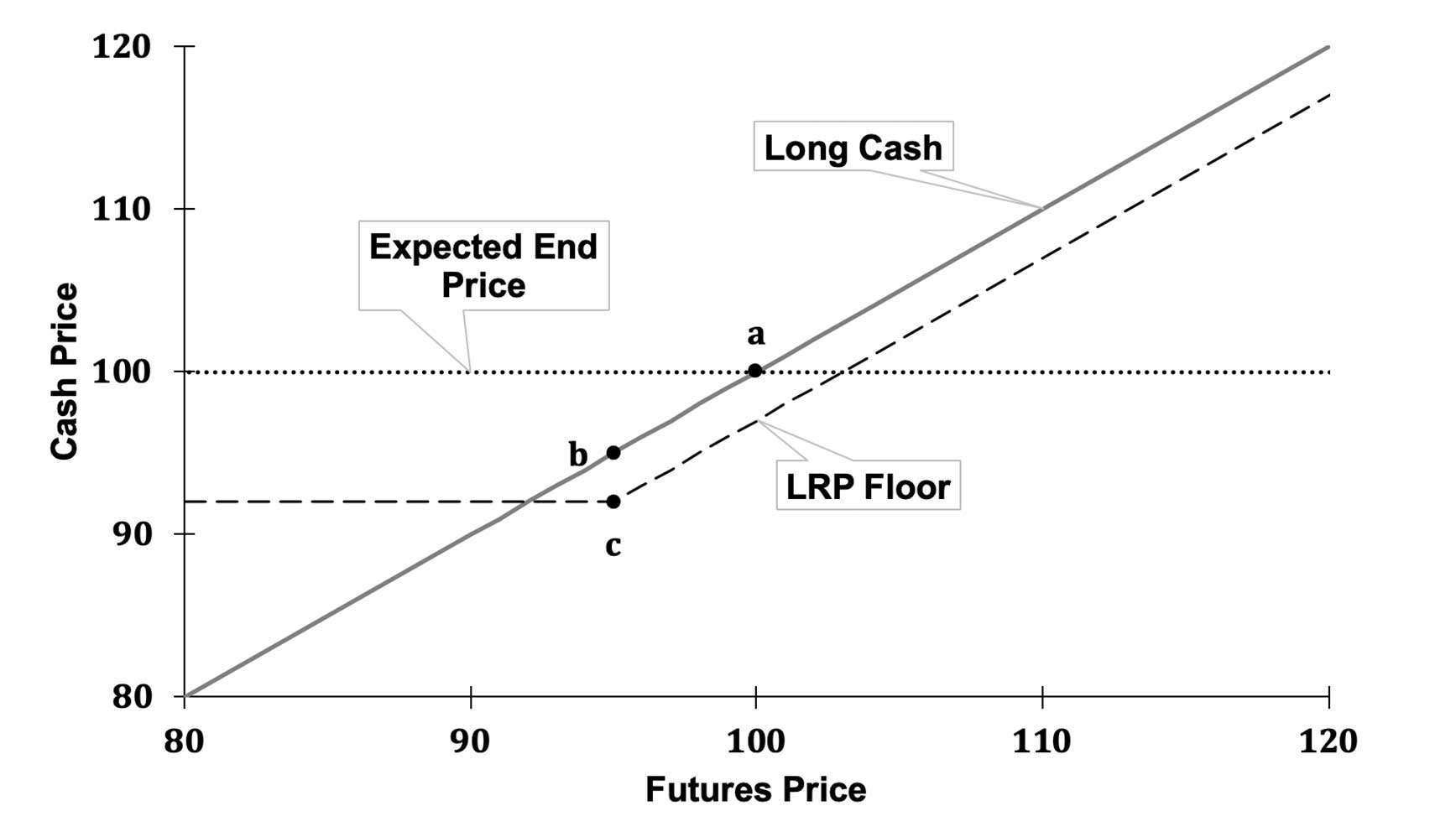

Understanding Animals Danger Protection (LRP) Insurance policy is vital for livestock manufacturers seeking to mitigate economic threats related to rate variations. LRP is a federally subsidized insurance product designed to secure manufacturers against a decrease in market costs. By providing insurance coverage for market cost decreases, LRP assists manufacturers secure a flooring price for their animals, guaranteeing a minimal level of earnings no matter market variations.

One key facet of LRP is its flexibility, enabling manufacturers to personalize insurance coverage levels and plan lengths to fit their details requirements. Manufacturers can choose the variety of head, weight array, protection rate, and coverage duration that align with their manufacturing goals and take the chance of tolerance. Comprehending these personalized options is crucial for producers to successfully manage their cost threat direct exposure.

Moreover, LRP is offered for numerous livestock types, including cattle, swine, and lamb, making it a functional threat management tool for livestock producers across different markets. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make informed decisions to protect their investments and make sure economic security despite market uncertainties

Benefits of LRP Insurance Coverage for Animals Producers

Animals manufacturers leveraging Animals Threat Defense (LRP) Insurance gain a tactical advantage in shielding their financial investments from rate volatility and safeguarding a secure economic ground among market unpredictabilities. One key benefit of LRP Insurance coverage is rate defense. By setting a floor on the cost of their livestock, manufacturers can mitigate the risk of considerable financial losses in the event of market downturns. This permits them to plan their budget plans a lot more effectively and make informed choices about their operations without the consistent concern of price changes.

Furthermore, LRP Insurance policy offers manufacturers with assurance. Understanding that their financial investments are protected versus unforeseen market changes permits producers to concentrate on various other aspects of their organization, such as improving pet health and welfare or maximizing production processes. This assurance can lead to raised efficiency and profitability in the future, as producers can run with more confidence and security. In general, the advantages of LRP Insurance policy for animals manufacturers are significant, offering a valuable tool for managing threat and guaranteeing economic security in an unforeseeable market atmosphere.

Just How LRP Insurance Coverage Mitigates Market Risks

Minimizing market risks, Livestock Threat Defense (LRP) Insurance gives livestock manufacturers with a dependable shield versus cost volatility and economic unpredictabilities. By using defense against unexpected price decreases, LRP Insurance helps producers protect their financial investments and preserve economic security in the face of market variations. This sort of insurance policy enables animals producers to secure a price for their pets at the start of the policy duration, guaranteeing a minimal price level no matter market modifications.

Steps to Protect Your Livestock Investment With LRP

In the realm of agricultural risk management, executing Livestock Risk Protection (LRP) Insurance coverage includes a calculated process to protect investments against market variations and unpredictabilities. To safeguard your animals financial investment successfully with LRP, the primary step is to evaluate the specific risks your operation faces, such as rate volatility or unanticipated climate occasions. Recognizing these risks enables you to figure out the insurance coverage degree required to shield your financial investment appropriately. Next, it is crucial to research and select a trustworthy insurance company that provides LRP policies tailored to your livestock and business needs. Carefully examine the policy terms, problems, and coverage limitations to ensure they straighten with your risk monitoring goals when you have selected a provider. In index addition, regularly checking market trends and readjusting your protection as required can help enhance your defense against prospective losses. By adhering to these steps carefully, you can boost the safety and security of your animals financial investment and navigate market uncertainties with self-confidence.

Long-Term Financial Protection With LRP Insurance Policy

Guaranteeing withstanding economic security via the application of Livestock Risk Protection (LRP) Insurance is a sensible lasting approach for farming manufacturers. By incorporating LRP Insurance coverage right into their threat monitoring plans, farmers can protect their animals financial investments versus unforeseen market fluctuations and damaging events that could jeopardize their monetary health with time.

One trick advantage of LRP Insurance for long-lasting monetary safety and security is the comfort it supplies. With a reputable insurance policy in location, farmers can reduce the financial dangers related to unpredictable market conditions and unanticipated losses because of factors such as condition break outs or all-natural disasters - Bagley Risk Management. This stability permits manufacturers to concentrate on the day-to-day operations of their animals business without consistent stress over potential monetary troubles

Moreover, LRP Insurance policy gives a structured approach to taking care of risk over the long-term. By setting certain coverage degrees and picking suitable recommendation periods, farmers can customize their insurance policy prepares to straighten with their financial goals and take the chance of go to website tolerance, making sure a safe and lasting future for their livestock operations. Finally, investing in LRP Insurance policy is a proactive method for farming producers to attain lasting economic safety and security and shield their livelihoods.

Final Thought

In verdict, Livestock Danger Defense (LRP) Insurance is a useful device for animals manufacturers to minimize market risks and secure their financial investments. By recognizing the advantages of LRP insurance and taking steps to execute it, producers can accomplish lasting monetary safety for their operations. LRP insurance policy supplies a security web versus price changes and ensures a level of stability in an unforeseeable market setting. It is a wise choice for safeguarding livestock financial investments.